KZ

Жаңа қорларды іске қосу

2026 жылғы 6 ақпаннан бастап «BCC Invest» АҚ «KASE индексі» ETF, «MBM Index KASE» ETF биржалық қорының пайларын және «BCC Euro» интервалдық инвестициялық пай қорының пайларын алғашқы орналастыруды бастайды.

Орналастыру мерзімі: 2026 жылғы 6 ақпан.

KASE индексі ETF

Қазақстан қор биржасының (KASE) өкілдік санаттағы акциялар индексі – KASE индексінің құрамын толығымен көрсететін индекстік қор. Қазақстан биржасының басты индексі еліміздің ең ірі, өтімді және қаржылық тұрақты компанияларының динамикасын көшіреді. KASE индексі ETF: ISIN KZPF00000983

MBM Index KASE ETF

Қазақстан қор биржасының (KASE) MBM_index индексінің құрамын толық көрсететін индекстік қор. Қор қаражатты ақша нарығының құралдарына (25%) және ҚР Қаржы министрлігі шығаратын өтеу мерзімі 2 жылдан 5 жылға дейінгі мемлекеттік бағалы қағаздарға (75%) инвестициялайды. MBM Index KASE ETF: ISIN KZPF00000983

«BCC Euro» ИИПҚ

Қазақстан Республикасындағы номиналы еуро болатын тұңғыш қор. Еуропаның борыштық нарығына экспозициясы және ірі еуропалық компаниялардың акциялары бар пай қоры. Қордың құрамында Еуропа мемлекеттерінің егеменді облигациялары (80%) және Еуропаның ірі және анағұрлым өтімді компанияларының акциялары (20%) бар. Бұл теңгерімді портфель қалыптастыруды қамтамасыз етеді және тәуекелді азайтып, инвесторларға ел экономикасының өсуімен қатар кіріс алуға мүмкіндік береді. ISIN BCC Euro: KZPF00001007

Moody's BCC Invest компаниясының ұзақмерзімді корпоративтік рейтингін көтерді

Moody's халықаралық рейтингтік агенттігі BCC Invest компаниясының ұзақмерзімді корпоративтік рейтингін Ва2 деңгейіне көтерді. Болжамы — «Тұрақты».

2026 жылғы 2 – 6 ақпан аралығындағы апталық шолу

Аптаның негізгі тақырыптары:

- Акциялар нарығындағы ротация

- Технологиялық секторды қайта бағалау

- Тәуекелге бейімділіктің төмендеуі

Неліктен бізді таңдайсыз

27 жыл

Қаржы нарығындағы ең бірінші инвестициялық компаниялардың бірі

₸146,4 млрд

01.01.2026 жылғы жағдай бойынша активтер бойынша ТОП 2

50,7%

Жеке инвестициялық қорлардағы және ашық пайлық қорлардағы басқарудағы активтердің нарықтық үлесі, 2026 жылғы 1 қаңтардағы жағдай бойынша

~₸10,65 млрд

2026 жылғы 1 қаңтардағы зейнетақы активтерінің құны, басқарудағы зейнетақы активтері бойынша ТОП-3

₸13,5 млрд

01.01.2026 жылғы жағдай бойынша компанияның таза пайдасы

₸306,92 млрд

Тартылған қаражат көлемі, андеррайтинг арқылы 01.01.2025-31.12.2025

Аналитика

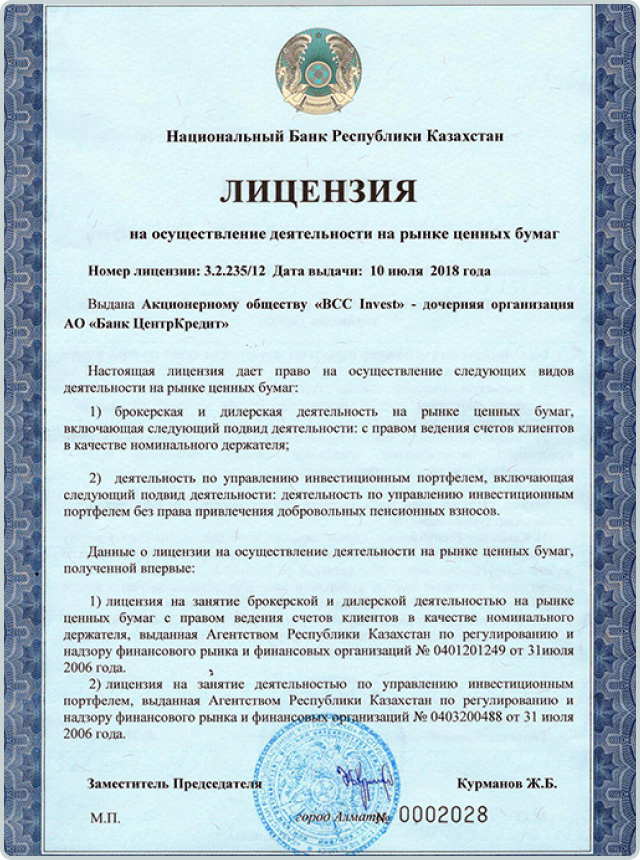

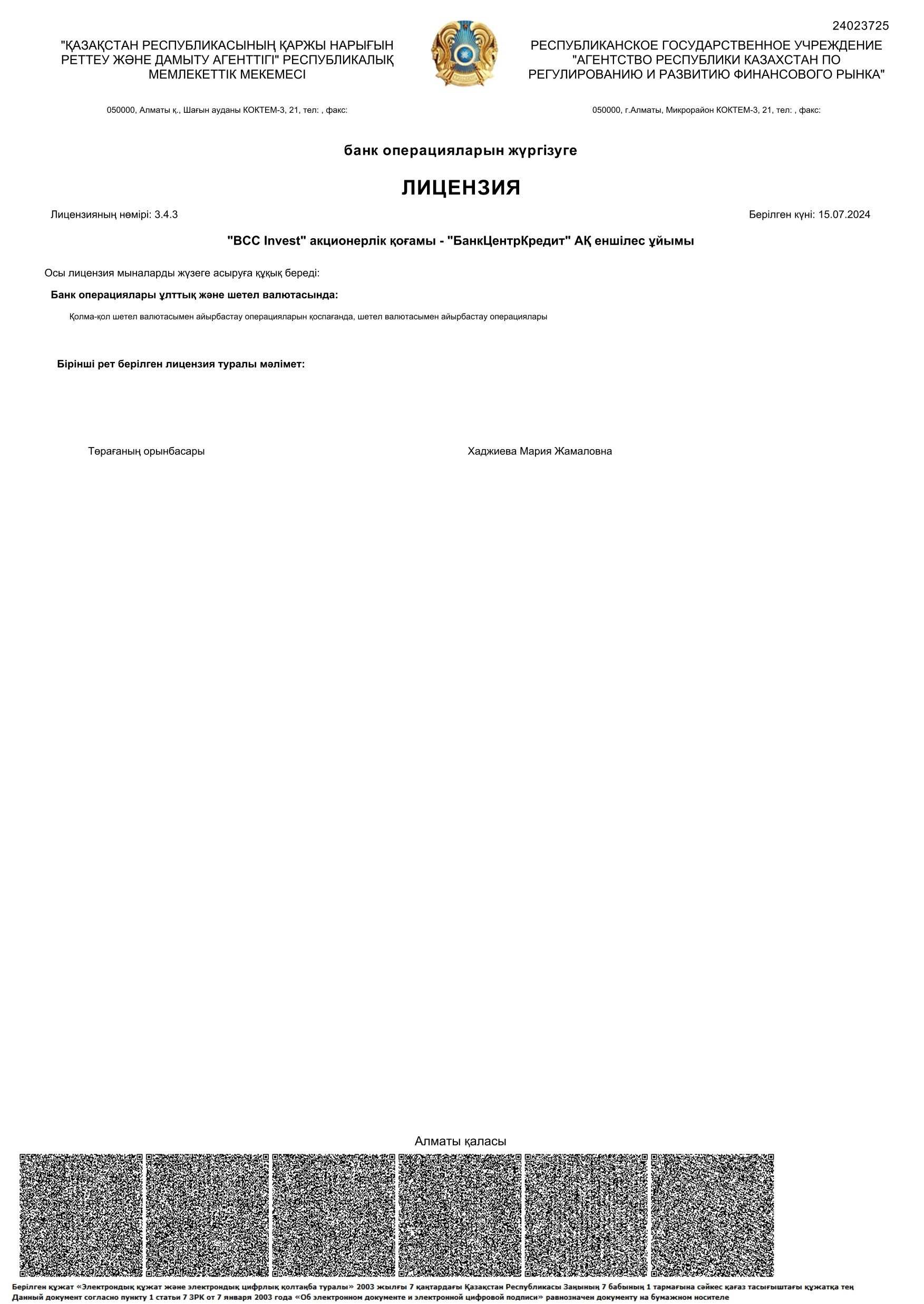

Марапаттар мен лицензиялар

Өнімдер

ИИПҚ "Валютный"

АҚШ долларында тұрақты дивиденд пен кіріс іздейтіндер үшін

$

5%Жылдық

ИИПҚ "Разумный баланс"

Теңгеде жоғары табыс пен орташа тәуекелді іздейтіндер үшін

₸

19-20%Жылдық

ИИПҚ "Wardat al Hayat"

ислам қаржысы қағидаттарына сәйкес клиенттердің қаражатын инвестициялайтын Қазақстандағы тұңғыш интервалды инвестициялық пай қоры

$

4%Жылдық

"KASE индексі" ETF-і

«Қазақстанның көгілдір фишкаларына» инвестиция салғысы келетіндер үшін

₸

20%Жылдық

"MBM Index KASE" ETF-і

Ақша нарығына және Қазақстанның мемлекеттік облигацияларына бір құралмен инвестициялаудың оңай жолы

₸

15%Жылдық

Біздің серіктестер